News

•

13 nov 2023

New Earth System Impact tool developed

To truly understand and mitigate the environmental impact of corporate activities, it is essential to look beyond carbon emissions alone. The Earth System Impact (ESI) score offers a comprehensice approach, capturing a broader set of environmental dimensions and emphasising the importance of geo-specific impacts. An ESI prototype tool is now ready to be tested on a site free and open for all.

The rapid increase in sustainable finance underscores the urgency of more robust Environmental, Social, and Governance (ESG) metrics. While the ambition of many investors is commendable, there is a discernible gap in current ESG metrics’ capacity to capture the full environmental impact. Unless remedied, this could misalign investments for climate impact, and create growing blind spots for both climate and broader systemic risks arising from interactions between climate and nature.

The Earth System Impact (ESI) score was developed by Earth system scientists at GEDB and Stockholm Resilience Centre in 2021 to offer a more nuanced understanding of environmental impacts, that accounts for key planetary boundaries and their interactions.

In continuation of this work, GEDB researchers Beatrice Crona and Giorgio Parlato recently unveiled a webpage that allows to test the ESI prototype. The ESI tool allows investors and companies to begin to assess the global impact of local corporate activities.

The novelty of the metric lies in the fact that the ESI is:

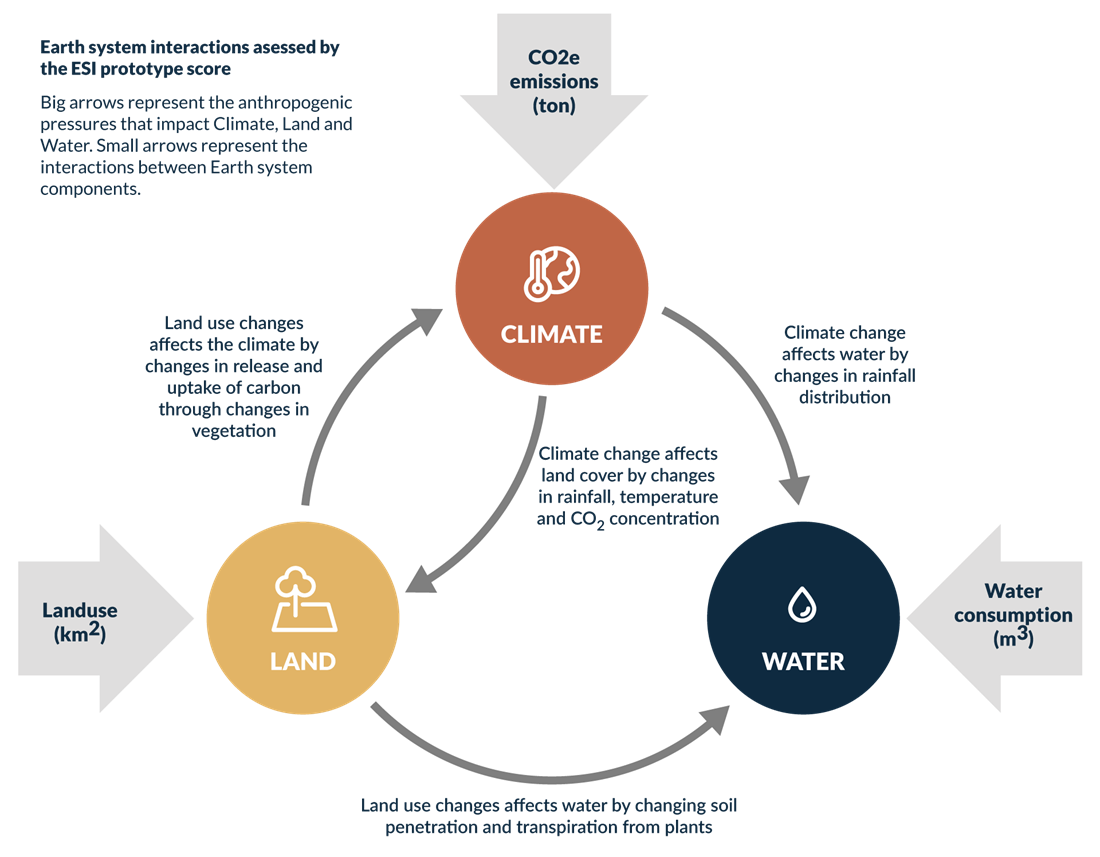

Systemic: it accounts for Earth system components other than climate (CO2), such as water and landuse, and most importantly, the interactions between these three

Context sensitive: it distinguishes impacts by region and vegetation type

Science based: it accounts for the current state of each Earth system component relative to scientifically estimated guardrails – i.e. it accounts for total availability

A short introduction to ESI can be found in this brief and for more information on how it can be applied by corporate actors, banks or other financial institutions see a preprint by Crona et al. 2023, which also includes a case study applying the ESI on a sample of mining companies.