Below are short summaries of ongoing and completed research projects

that have contributed to the development of the Earth System Finance work at GEDB. The list is not exhaustive, and more work can be found by looking through our publications.

to current discussions about the role of finance for sustainability. We have examined and elucidated the connections between finance and capital markets and tipping elements in the Earth system.

Our aim is to provide improved ways of assessing corporate and financial impacts that are more Earth system savvy.

Read more about our science-based prototype Earth System Impact score for corporates and investors.

that have contributed to the development of the Earth System Finance work at GEDB. The list is not exhaustive, and more work can be found by looking through our publications.

A climate neutral economy is essential to reach Paris 2°C targets. But while reduction of greenhouse gas emissions is essential to stave off dangerous climate change, humanity also needs to develop strategies to avoid transgressing thresholds in other key Earth System processes.

Read more

We develop 15 “Essential Environmental Impact Variables” (EEIVs), starting with seven primary industries, which capture the most essential information on key environmental impacts of those industries at local and global scales. By focusing on what is most essential, we could reduce reporting burden whilst providing more meaningful information.

Read more

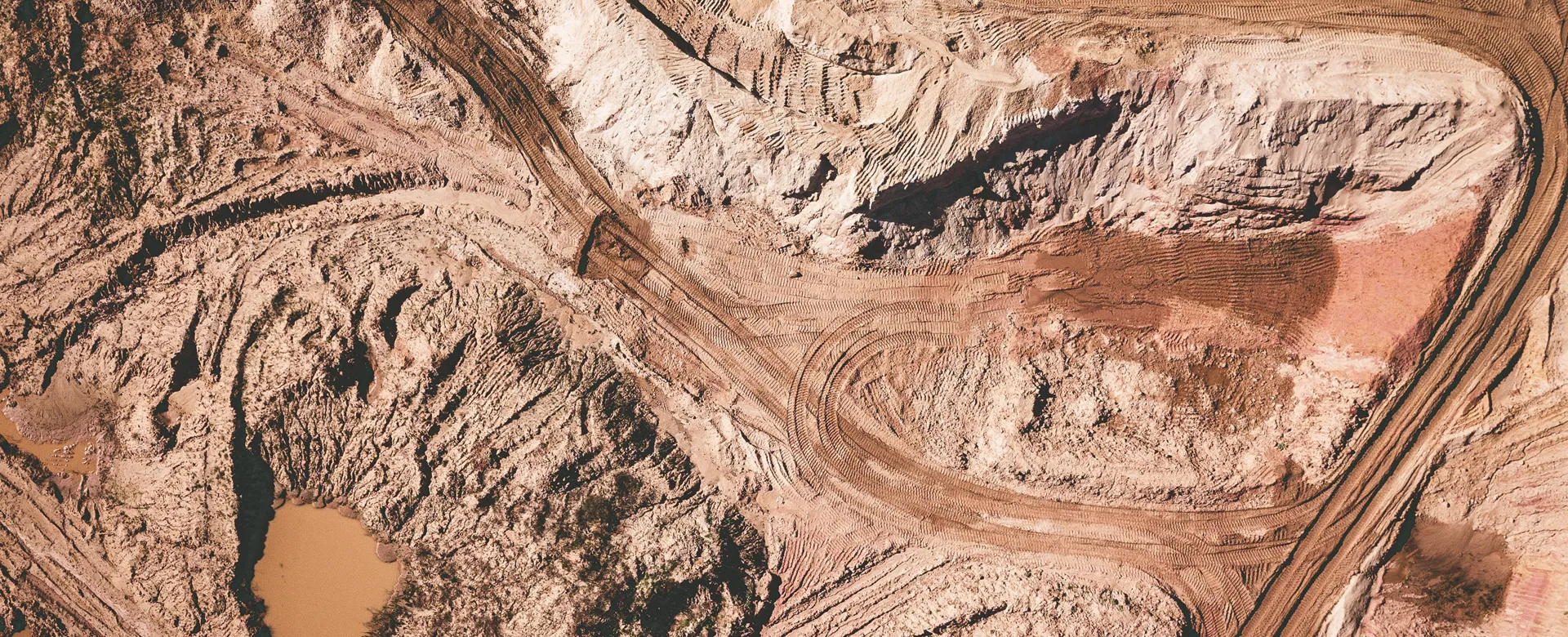

This research project, conducted under the initial years of GEDB, laid the foundations of much of the work on the Earth system and sustainable finance that we conduct today. The project deployed value chain analysis and trade data to identify financial institutions who, based on current ownership patterns, are linked to tipping elements in the Earth system. Therefore, they play a particularly important role for steering away from irreversible large-scale environmental change and escalated global warming.

Read more

Black carbon gives rise to what is often referred to as the Atmospheric Brown Cloud (ABC) over South Asia. It is created by a range of airborne particles and pollutants from combustion, biomass burning and various industrial processes.

The black carbon particles have a significant effect on the climate change, as well as on the health of local population and the biosphere. This research linked the economic activities contributing to black carbon emissions to the finance sector through the innovative use of emission inventories, wheat and...

Read moreOther

SeaBOS. 2022. Released at the UN Ocean Conference, Lisbon, Portugal, 2022.

Other

Lindahl, T., C. Schill, D. Collste, A.-S. Crépin, C. Folke and V. Galaz. 2022. Report for Stockholm+50. Beijer Beijer Institute of Ecological Economics, Royal Swedish Academy of Sciences and the Stockholm Resilience Centre, Stockholm University, Chapter 6.

Other

Ingram Bogusz, C. and S. Kashyap. 2022. ECIS 2022 Research Papers 113.

28 maj 2024

Nature Action 100 is a global investor-led engagement initiative focused on supporting greater corporate...

27 maj 2024

The year 2023 saw a sad record, with 63 major weather-related disasters hitting the world, each resulting...

12 feb 2024

Humankind risks getting stuck in evolutionary traps, ranging from global climate tipping points to misaligned...

17 dec 2023

GEDB researcher Malin Jonell and her team have received a SEK 10 million grant from the Swedish research...